Treasury Town Hall w/ Will Papper (September 23)

Treasury risk and governance by veto with a blitmap, cool cat, and a moonbird

$RDAO holders met for a Rug Radio Treasury Town Hall on Friday. Why was it on a Friday night? Blame Farokh.

TLDR: Syndicate is conservative with their own treasury. Most members felt a conservative strategy is best for the $RDAO treasury to protect capital and allow the project to focus on building. Here’s our recap 👇

🏦 Treasury Town Hall

Will Papper led a discussion on Rug Radio treasury management Friday evening.

“Rug Radio should have expenses expire and require renewal. It's very easy for DAOs to start spending in an area and very hard to cut back if it stops working, so expiring spending helps force a renewal discussion and makes "not spending" the default.”

✅ Core team already followed this advice with its 6-month Budget Proposal and Operational Council framework.

Voting/Governance: Large DAOs can be difficult to manage. It is better to solve in smaller groups and to maintain domain expertise.

🧑⚖️ Will’s preferred mental model is ‘governance by community veto,’ but notes that some DAO operators disagree. The other model is collective decision-making which is slow and can cause voter fatigue and in-fighting.

It is a good thing that Rug DAO does not need to take risks with our treasury. For DAOs that do take risks, critical to consider risk profile. If needed, can hire a professional like llama for treasury management. Will is open to organize an intro for a presentation by them.

There is $RUG Token Regulatory risk to providing liquidity to Rug Radio’s own tokens. Lawyers! Regulatory risk in linking $RUG to a monetary value. Don’t call it money! $RUG should not be used for compensation but instead as an additional reward, like air miles.

Global Reputation management using Syndicate ERC-721m

Modular NFTs for different use cases (reward DAO contributors…etc). Could vest or stream $USDC or $WETH or $RUG. Can be used to upgrade or downgrade roles within the DAO. Syndicate is still experimenting. If Rug DAO wants to explore, we can speak with Syndicate.

🫂 Community Discussion

@afearfuljesuit: Better be conservative with treasury. Not worth it to take more risk. Not the goal of the DAO. No idea what is the level of counter-party risk here.

@genius4hire: What we are doing here is risky already. (Building in web3, holding $ETH in treasury)

@barrylime: Favors more active treasury management. Every single business has treasury management. No business stays fully in cash

@MUHAMMADI: Should not be an all or nothing decision. Could experiment with part of the treasury

@rektgrateful: We don’t have that much treasury for yield to make a significant impact. Core team is not Defi native, could put pressure/distract them. Open to more active treasury management if we had bigger cash positions.

@Branigan: Open to ideas. Want to learn/discuss more with the Rug Radio community.

🙌 Special thanks to RektGrateful for notes and Maxand98 for revisions.

🔗 Further Reading

Join the discord thread: “Treasury Management Discussion” in RDAO Proposal Ideas to continue this discussion.

Rug DAO’s Budget framework proposal that passed requires:

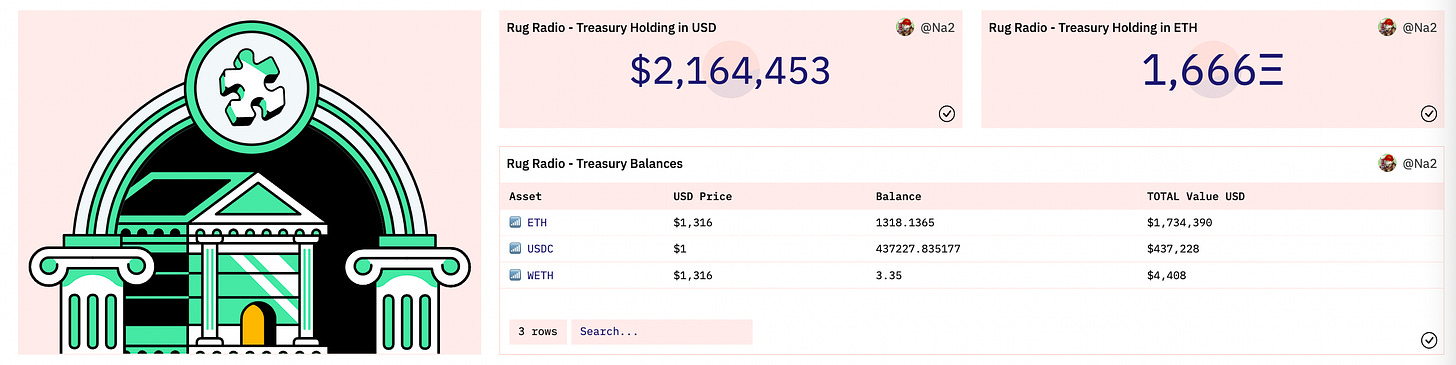

Treasury can only hold ETH, wETH, USDC, RUG and RDAO

Treasury should always cover tax costs each year in stables (USDC)

Minimum allocation to stables 20%, Maximum allocation to stables 50%

Treasury can put USDC/ETH in a farming pool on Uniswap (26% yield).

Here is our Dune Dashboard: Rug DAO Treasury Balances

Can you help raise $1,000 $USDC for @Natou.eth’s excellent work? DM us.

Next Community Town Hall — Friday, October 7. Time: TBA

What do you want to talk about? Create the agenda here